Introduction

What’s up, guys? Today we have a pretty unique topic. We talk about a lot of different Defi farms and staking methods. Today, I’ll break down my favorite ways of earning passive income in the Defi space. At the moment, how do I increase my position in the tokens? that I am bullish. So we’re going to take how I am allocating my funds and the current narratives on the market. Where the device space is going here in the upcoming months and how I plan to play this out.

The Macro DeFi Landscape

So, the first thing that I want to discuss in today’s blog.

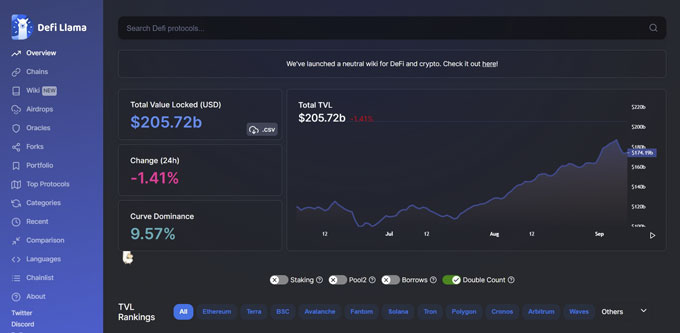

What I think is essential to be up-to-date with is the current macrostate of the Defi space. Because bitcoin is in this accumulation phase, we range between 35 to 45. That also means no new money is entering the crypto space, particularly Defi. We can see that we peaked at losing a bit of value, and no new money has entered. And therefore, you can say that based on the TBL, we are playing this zero-sum game where for an ecosystem or protocol to gain value to gain TBL.

Well, it kind of needs to take it from somewhere else in the crypto space. So this is a good and a bad thing in my opinion. Because, on the one hand, it kind of sucks that now it’s not DeFi against tread fire. It’s more like free for all, everyone.

It is trying to attract as much liquidity as possible, and we need to take this from each other. But on the other hand, we can also really see that the blockchains, the Defi ecosystems, can attract a lot of liquidity right now. Well, they are very likely. Also going to show a lot of strength when the market eventually turns bullish. These are the ecosystems that are still onboarding new users.

There’s still a lot of innovation going on from developers creating new protocols. If we are to identify these upcoming vital ecosystems and these upcoming narratives. So the most emotional report that I see now, especially when it comes to Defi. I genuinely think that 99% of these projects are over valuable.

Why Terra Is A Strong Narrative

So, let’s start by talking about my most substantial bet, and this narrative is the Terra blockchain.

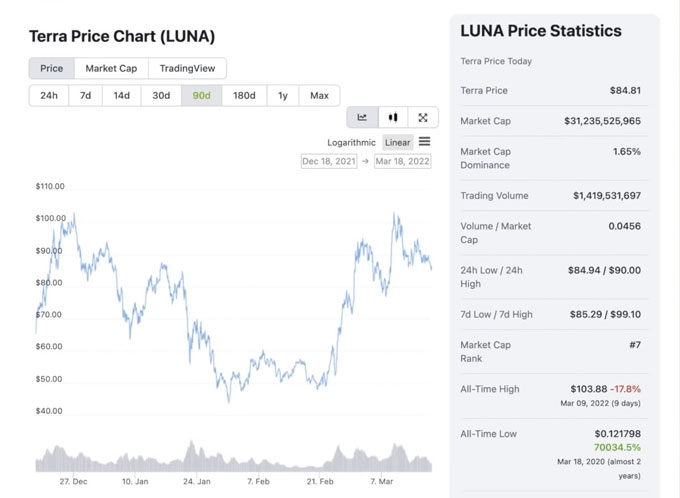

We started talking about Luna last summer when we were sitting at around $10, and I’ve been incredibly bullish ever since. The reason that Tara Luna is my most significant bit. It is that not only are you bidding on this narrative of layer one blockchain increasing in value. You’re also betting on the growth of stable coins, more specifically decentralized stable coins. Which is going to be incredibly valuable in the future.

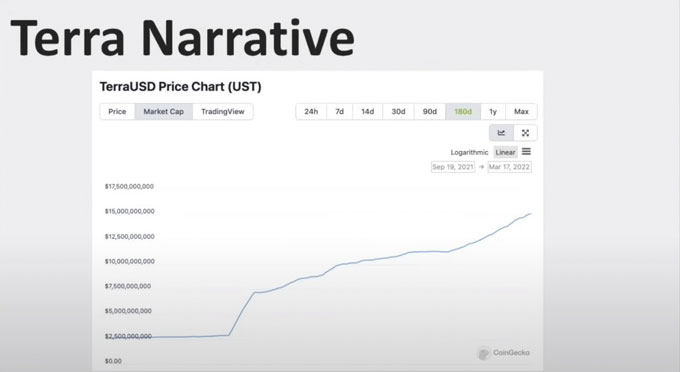

More than it already is, in my opinion, why I heavily invest in Luna. From the image here, you can see the growth of the market cap of UST, which is just growing to an insane amount of around 15 billion dollars. which has just been growing exponentially. Furthermore, dokuan is one of the most intelligent people in space. He is the front guy of Tara Luna.

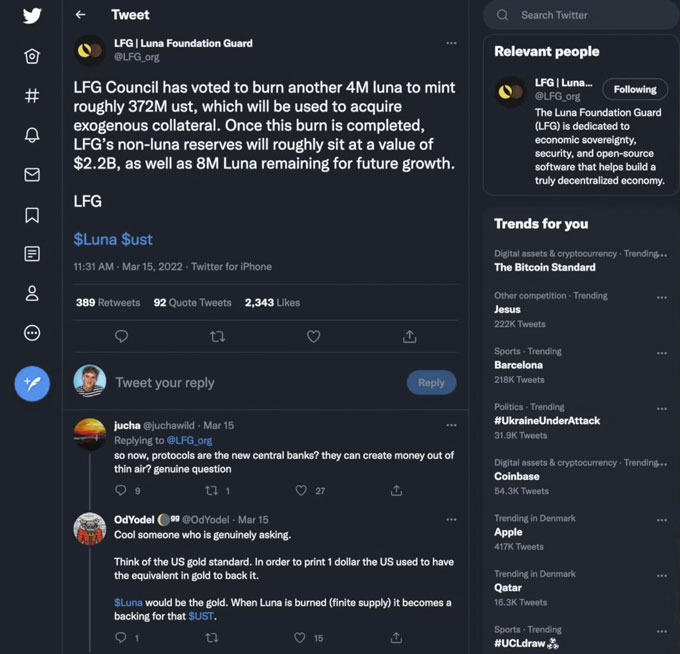

He has done so many great things, such as making a 3 billion bitcoin reserve to maintain the peak of UST. to make it even more friendly for people skeptical about crypto and stable coins. He just filled up the anchor protocol with 500 million dollars as a huge marketing move to attract a lot of new liquidity and new users to the ecosystem. Another also stable coin here on Terra well, you essentially need to burn Luna, meaning that the supply is just decreasing to a great extent.

How I Invest My LUNA & UST

If we also talk about my strategies and portfolio allocations. Because of all of these macro uncertainties with these geopolitical conditions and stuff like that, I am not as exposed to the crypto market. Once I was, and around 40% of my portfolio is sitting in stable coins, all stable coins are. However, the anchor protocol UST and all these coins are Parkes. So to further talk about my crypto portfolio, the money I have in the market just said that around 40% of my portfolio was in stable coins. Well, approximately 35% is in Luna.

It’s a huge allocation. But I am incredibly bullish on Luna’s narrative and think there are many upsides left for the token. I once read a quote from Warren Buffett saying something along the lines of your second-best idea. will never be as good as your best idea, and of course, it’s a good idea to diversify, and that’s also why I have some money in stable coins. But honestly, Luna is my biggest bet by far. Because by far, I see the most upside and potential for this narrative and this token despite. The current market cap of Luna sits at around 30 billion dollars. I know a lot of upsides for the price.

First and foremost, we do not even need to increase the market cap for the price of Luna to increase. Because of this deflationary system when printing UST. At the same time, because this ecosystem is growing exponentially fast in the future, a market cap of above 100 to 200 billion dollars is not unrealistic compared to Ethereum or bitcoin. More and more overall adoption into the crypto space is possible.

Once again, a thousand dollar Luna is not a meme. But I mean that by bidding on this narrative that UST will adopt more and more in the real world through real-world payments like Alice and Orion money. And stuff like that, and also in different DeFi ecosystems. So, what do I do with my Luna? Well, of course, I want to increase this position. I want to earn Luna for free through a passive income through these different DeFi strategies.

The Cosmos Narrative ecosystem

So let’s move on to the next bit I’m making in this narrative: the cosmos ecosystem.

What I think we are missing in the space or the entire crypto space actually at the moment other than scalability is interoperability, meaning that different blockchains can communicate with each other. It is a big problem we are currently facing, which the cosmos is solving in a pretty unique way through this inter-blockchain communications protocol. SDK Means the cosmos built all of the different blockchains.

The standard development kit is Tara, Luna, the Binance Chain, the osmosis Thor chain, Juno, and crypto.com. To mention some of the largest ones, they are essential if they switch on the IBC to communicate. It is also why a text and AMM like osmosis, which is on its blockchain, can integrate assets from other blockchains like Luna and UST and Adam and Juno and stuff like that all in one protocol. which is advantageous and not something that we’re seeing.

Anywhere else in the crypto space currently, and so there is a lot of innovation going on here. A strong community built through a chain makes its life dependent on it. We’re further seeing Ethereum virtual machine compatibility with most launching soon, meaning that a lot of dabs over on Ethereum can easily convert over to the cosmos ecosystem for this interoperability, which is super beneficial. Something I’m excited about the gravity bridge is launching soon a lot of upcoming catalysts that could further boost this ecosystem and the price of the native tokens here.

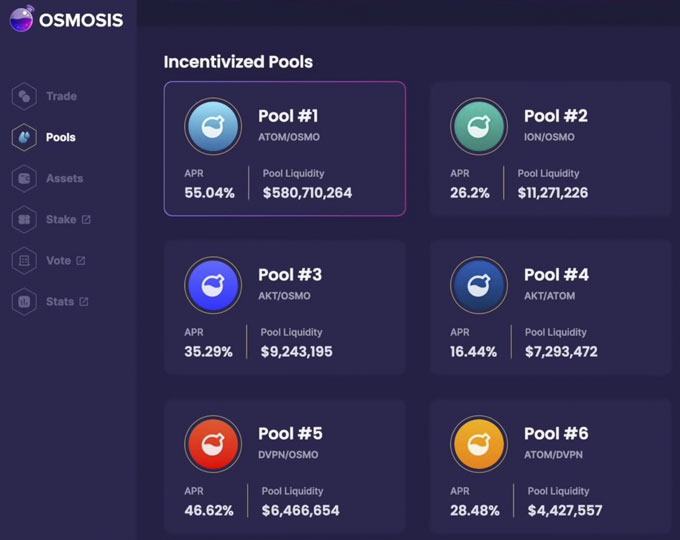

So outside of Luna, UST, I also have a significant allocation in this ecosystem. Most of these funds are in osmosis in liquidity pools with either Osmo or atom, Luna or UST. Because you are getting high yields on insane pairs, swift transactions, and no transaction fees, which is just incredible, really one of the best deck experiences across the entire device space. Currently, additional superfluid staking means that the Osmo is in the liquidity pool. You can also stake this simultaneously to earn even higher rewards for innovative and unique technology going on here, which is just so beneficial for the user.

Avalanche & Subnet Revolution

So the final bit that I’m making in this layer one narrative is the EVM chains, specifically phantom and avalanche.

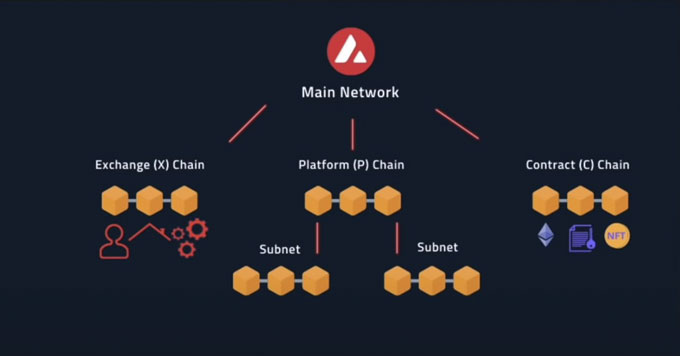

Finally, the avalanche is one of these EVM chains that I see a lot of value in. it is also about these catalysts. More specifically, being the subnets for an avalanche. I think this will bring a lot of value to this ecosystem. I genuinely believe in a multi-chain future with application-specific blockchains.

We’re seeing how great this works for osmosis. It’s an application-specific blockchain because it is only a decentralized exchange on the osmosis blockchain. The benefit of this is speedy transactions. Zero percent fees and the security from the cosmos ecosystem. And this is also something similar to that avalanche is building with these subnets. Which can have these application-specific chains.

There is a great speed, excellent security from the avalanche blockchain, and cheap transactions. I recommend that you check out the protocols on avalanches. You will see a lot of value in trader Joe and platypus finance. For example, I think the plug was acceptable and will integrate UST soon. Furthermore, this cross-chain expansion from the anger protocols avalanche is relatively bullish. So, all in all, there is a lot of potential in an avalanche for you.

FAQs

What is DeFi?

DeFi (pronounced dee-fye) is short for decentralized finance. It’s an umbrella term for the part of the crypto universe that is geared toward creating a new, internet-native financial strategy, utilizing blockchains to replace traditional intermediaries and trust mechanisms.

See More:

How To Receive Ultimate Free Crypto Airdrops | 3 Best Method

Top 10 Cryptocurrency in May 2022

What is USD coin, values | USD coin price prediction

How To Become A Blockchain Developer? Earn Unlimited Money As A Blockchain Developer.