Introduction.

Do you want to make money online just by watching the video? Then, try WowTube App, a reward app that pays you to watch short videos for free!

The commercial also entices the audience with the chance of winning $500.

What is WowTube App?

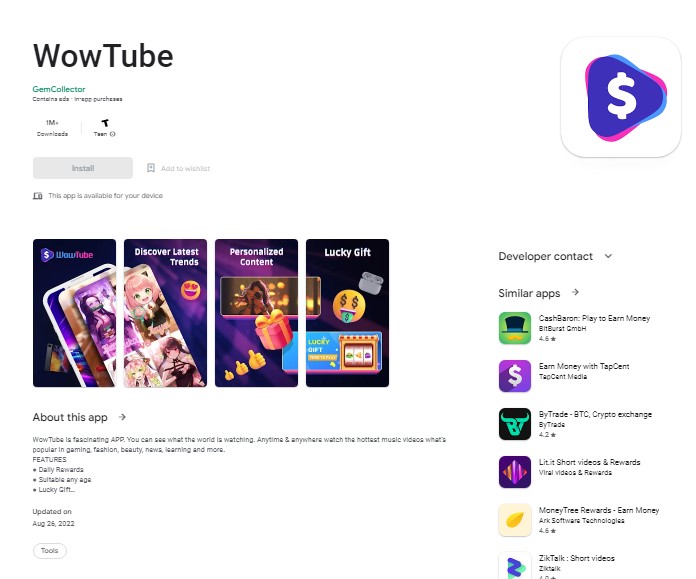

Many such apps are available in the Play Store, allowing you to earn money by playing games or watching videos. Wow Tube is another reward app that tries to convince users they can win thousands of dollars for watching fun videos. Wow tube, early access app, is an android gaming app available in the play store. Wow tube app shows you earn money playing games by watching the video. Status means earned coin. They can convert into money by redeeming it. For withdrawal, there is the option to withdraw in wallets like PayPal, Paytm, Mobikwik and Amazon. There are many other ways to earn in the wowtube app, such as gift option, double bonus, etc.

How to download WowTube App?

Most of the mobile apps are available in Play Store. Also, there is WowTube App in Play Store.

You can download WowTube App from Play Store if you like. If you want to download the ancient version, then any third party Can be downloaded it from the website.

How Does WowTube App Work?

WowTube shows shorts from YouTube and provides you with cash rewards for watching sponsored videos. WowTube app makes money through its user who pays money to its user. It keeps some of that money and delivers some to its user. You know how this process functions whenever a user uses the WowTube app to earn money, like watching short videos. At the same time in WowTube app will see some advertisements.

WowTube app earns money from these ads, and users pay part of them. Have and keep some with you. That’s how WowTube works.

How to make money by watching videos on WowTube?

To operate the WowTube app, open it after downloading it from the Play Store. Once you have the app, the dashboard will arrive at the forefront. Here is what the video and game gift payment section looks like These sections have different categories like video section, hot videos, funny videos short videos like games. You can earn money by doing all these tasks. WowTube friends, we have used this app and found that there is a lot of money to make on WowTube. Some video ads can only get a lot of money.

How to start watching the video?

After founding WowTube, watching YouTube shorts as you do on the official platform became appropriate. To collect virtual cash, you must wait for the progress bar to finish and click the treasure chest.

However, you don’t require watching any video to make the bar action to the right!

The whole point of WowTube is to expose you to their advertisements every time you receive a cash reward.

How to double your earnings?

Once you open the treasure chest, you will get Chance bonuses worth a decent quantity of money. Then, of course, you can click the button and watch a commercial to double your profits.

In the beginning, you will earn hundreds of tokens worth a decent amount of money.

WowTube Payment method.

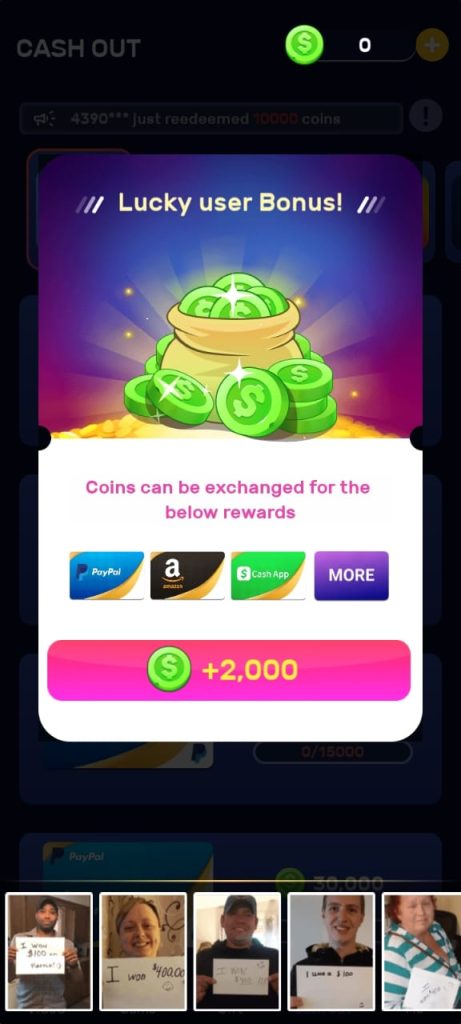

You can withdraw the money by selecting the cash-out icon at the bottom or the token balance at the top.

Five payment options are available to you, PayPal, Amazon, Google Play, Cash App, and Steam.

However, you cannot redeem until you reach 5000 tokens ($500). That’s not the issue, though. Once you collect $500 and try to cash out, you will be prompted to enter your account connected to PayPal or another cashout method.

FAQs

How Do I cash out?

You cannot redeem until you reach 5000 tokens ($500). Once you collect $500 and try to cash out,

What kind of video WowTube display?

WowTube shows shorts from YouTube and provides you cash rewards for watching invested videos.

How Do I Get Paid?

Five payment choices are available to you PayPal, Amazon, Google Play, Cash App, and Steam.

See More:

Coin-tub.com Review | 3 Easy Ways To Earn Money

Points2Shop Review – 6 Easy Ways To Make Money From Points2Shop

Gift Hunter Club Review | 8 Easy Ways To Make Money From Gift Hunter Club